Home Equity Loan Vs. HELOC: Which One Is The Best Option For You?

Want to secure either a home equity loan or HELOC? Getting these types of loans is next to impossible if you have little to no equity in your home.

Some factors like credit score, proof of income, or DTI ratio can make or break your approval for these types of loans. Although both loans have their drawbacks, they can be helpful to a homeowner during a difficult financial situation. With these types of loans, ensure you weigh your options before opting for either.

Let's dive deeper into this article so that you will know the differences between both loans and which option is best for you.

What Is Home Equity?

Home equity refers to the amount or portion of the appraised value of a home that a homeowner owns. The appraised value of a home is a fair market value given by a professional real estate appraiser.

To know the amount of equity in your home, subtract your mortgage from the appraised value of your home.

For instance, if the appraised value of your home is worth $250,000, and you have a mortgage balance of $200,000—the equity, in this case, will be $50,000. So, you own $50,000 worth of home equity.

Before you apply for a home equity loan or HELOC, make sure you have enough equity in your home. As you pay your mortgage, you build equity in your home, which improves the possibility of getting approved for either of the loans.

What Is A Home Equity Loan?

A home equity loan is a second type of mortgage a homeowner takes while putting their home up as collateral. This type of loan enables you to borrow funds through several home equity loan providers.

Loan providers usually approve loan requests of borrowers with a loan-to-value ratio of 80% or less. If you have a loan-to-value ratio of 80% or less, you also increase your odds of benefiting from a low-interest rate.

The loan-to-value ratio compares your mortgage balance to the value of your home. For example, if the appraised value of your home is $290,000, and you have paid up to $60,000—you will need to subtract the amount you paid from the appraised value of your home to get the mortgage balance. Your LTV ratio will be ($290,000 - $60,000) / $290,000.

The LTV ratio is 79.3% ($230,000 / $290,000).

Your lender will also check your credit score before you can secure a loan. A good credit score is one of the requirements needed to be eligible for a home equity loan or HELOC.

Most lenders allow you to borrow up to 80%-85% of the value of your home or combined loan-to-value (CLTV) ratio. For example, if your home is worth $300,000, and you have a mortgage balance of $60,000.

Here’s the calculation for 80% of the amount of home equity loan you can get: (80 × 300,000) ÷ 100= $240,000. Now, subtract $60,000 from $240,000 to get the actual value of the loan you can borrow.

Here is the amount you can get: $240,000 - $60,000= $180,000.

With a home equity loan, you get a lump sum with a fixed-rate payment. Ensure you can pay your loan according to the loan terms or risk losing your home to the lender. Another downside to this loan is that if the market value of your home drops, your home equity will reduce, and you may incur debt.

What Is A Home Equity Loan Used For?

You can use it for business, home improvement, or investment. You can also clear medical bills, tuition, and more with a home equity loan.

NOTE: You are putting your home on the line, so it would be much better to use this type of loan for important reasons (the same principle applies to a HELOC).

What Are The Requirements For A Home Equity Loan?

Before you can secure a home equity loan, these are the requirements you must meet:

🌀Having a verifiable income history for up to 2 to 3 years

A verifiable income history indicating a good source of income can enhance your chances of getting approved. Lenders will assess your income history by checking your last two years of federal tax return (through form 1040), bank statement, profit/loss statement, credit report, and debt-to-income ratio.

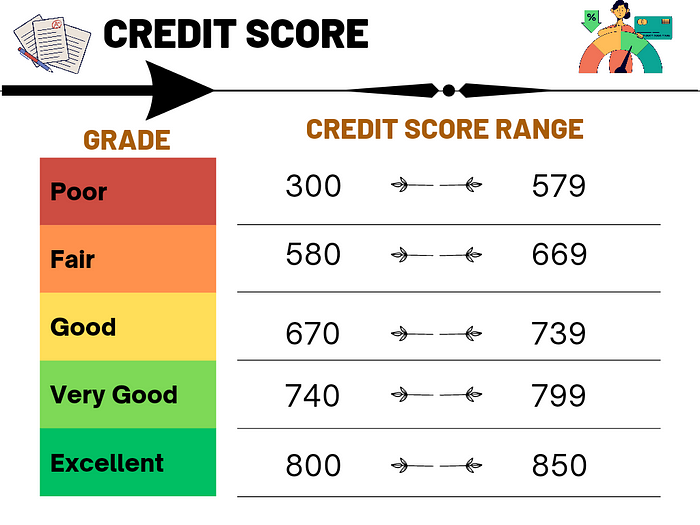

🌀A credit score that is 670 or more

Ensure you have a good credit score. Some lenders can also approve a home equity loan or HELOC if your credit score is within the range of 620-669. If your credit score is below 620, try to improve it before applying for the loan. A credit score of 700 and above may help you benefit from a fair interest rate.

🌀Debt-to-income ratio (DTI)

You can calculate your DTI ratio by adding up your monthly debt payment. After that, divide it by your gross monthly income and multiply it by 100. Most lenders accept a maximum DTI ratio of 43% for a home equity loan or HELOC. Note that a borrower with a DTI ratio of 36% or less is more attractive to a lender. The higher the DTI ratio, the bigger the debt you have, which can affect the approval of the loan.

🌀A home equity of at least 15%-20% of a home's value

Ensure you own up to 15%-20% home equity to fit one of the main requirements for a home equity loan.

For example, if your home is worth $600,000 and $480,000 makes up your mortgage balance, your home equity would be $120,000 ($600,000 - $480,000).

To get the percentage, divide $120,000 by $600,000 and multiply it by 100.

($120,000 ÷ $600,000) × 100= 20%

From the example above, we have a 20% home equity.

If you don’t have enough home equity, continue building your equity by paying off your mortgage consistently.

Pros Of Obtaining A Home Equity Loan

1) Fixed-rate payment

You don't need to worry about variable interest rates when obtaining a home equity loan: you only need to pay the same interest rate and principal monthly.

2) A wide repayment margin

With a home equity loan, you have the opportunity of repaying your loan within the time frame of 5 to 30 years. This can ease your anxiety when repaying the loan because of the long time frame you have to pay off your debt.

3) Lower rates

With a home equity loan, you can benefit from a lower interest rate than unsecured personal loans or credit cards.

4) Tax-deductible interest

If you're obtaining a loan to buy a house or improve your home, you can deduct the interest on the home equity loan.

5) Lump sum payment

With a home equity loan, you can borrow a lump sum, which can be beneficial when you need funds within a limited timeframe.

Cons Of Obtaining A Home Equity Loan

1) You risk losing your home

If you don't repay your mortgage loan, you'll increase your debt, and when you don't pay after a significant period (usually after 120 days), the lender will start the foreclosure process on your home.

2) You won’t benefit from favorable changes in the interest rate

Though the monthly payments for a home equity loan are predictable due to the fixed interest rate—you won’t benefit from the changes in the interest rate if the HELOC interest rate drops below the interest rate of a home equity loan.

3) High closing costs

Most home equity loans come with high closing costs. The closing costs add up to 2-5% of the loan.

4)You can owe more than your property’s worth

If the value of your home declines significantly in the real estate market or goes underwater, you’ll owe more than the value of your home, and you’ll still need to repay the loan.

5) Need to pay interest on the entire borrowed funds

If you get a home equity loan and end up not using the entire amount you borrowed, you will still need to pay the interest that covers the complete loan throughout the loan term.

Repaying A Home Equity Loan

Home equity loans are paid monthly within a time frame of 5 to 30 years. If you can pay the mortgage loan in 5 years, go for it. The shorter the term of the loan, the lower the interest rate, which allows you to clear your debt quickly and build equity fast. On the other hand, you can easily qualify for a 30-year loan since the monthly payment is lower than other loan terms. The 30-year loan is also beneficial to homeowners with a high DTI ratio. Choosing an ideal loan term boils down to your budget.

Home Equity Loan Calculator

Know how much you'll repay monthly with a home equity loan. Check out the home equity loan calculator from First Merchants Bank. You'll need to input details such as the loan amount, interest rate, and the loan term.

What Is A Home Equity Line Of Credit (HELOC)?

Like the home equity loan, a HELOC is a second mortgage that requires you to put your home up as collateral. It is a revolving line of credit that works like a credit card.

With a HELOC, you only pay interest on the amount you withdraw from your line of credit. This type of loan also gives you easy access to funds when necessary.

The HELOC has two periods—the draw period and the repayment period. The total amount you can withdraw during the draw period will not surpass 80%-85% of your home's value minus the mortgage balance.

What Is A HELOC Used For?

You can also use a HELOC for home improvement, business, medical bills, tuition payments, paying off credit card debts, and more. It is best to secure it for essential purposes.

What Are The Requirements For A HELOC?

🌀Having a credit score that is up to 670 or more.

🌀Owning up to at least 20% equity in your home.

🌀Verifiable and stable source of income for at least two years.

🌀Your debt-to-income ratio should not be more than 43%.

Pros Of Obtaining A HELOC

1) Flexibility in withdrawal

Compared to a home equity loan that allows you to access a lump sum, a HELOC, on the other hand, lets you withdraw money whenever you need it.

2) Opportunity to avail flexibility in repayment

The repayment plan for a HELOC is quite different from a home equity loan. During the draw period of a HELOC, you can borrow more money for 5 to 10 years. You are required to pay the interest within this period. When the draw period ends, you won't be able to borrow money any longer—you will now be in the repayment period. In the repayment period, you start paying the loan in 10 to 20 years.

3) Low-interest rate and APR

When comparing a HELOC to a regular credit card, a HELOC is a much better option due to its lower interest rate and annual percentage rate (APR).

4) Tax-deductible interest

According to the IRS, when you use a HELOC to build, buy, or improve the home you used as collateral, you can deduct the interest on the HELOC if you meet certain conditions (also applicable to a home equity loan).

5) Wide repayment time frame

You can repay your HELOC in 10 to 20 years. If your finances are tight, you can benefit from the HELOC convenient repayment period by budgeting your money and making a lesser monthly payment than a short-term loan.

6) Repay only the amount you used

You only need to repay the interest plus the amount you withdrew from your line of credit.

7) You can enjoy lesser monthly payments

If the HELOC interest rate drops, your monthly payment will be less, which is an opportunity for you to save more.

Cons Of Obtaining A HELOC

1) You could lose your home

If you don't repay your loan according to the loan agreement, your lender may reduce your credit limit or freeze your credit line. The lender can also foreclose on your home by taking ownership and potentially selling it.

2) Increased tendency to splurge

Due to the easy accessibility to funds, you may end up overspending. Although, you can still manage your spending so that you don't incur debt.

3) Inconsistent interest rate

Different variables like supply and demand, government regulation, credit risk, or inflation can increase or decrease the interest rate of a HELOC.

4) High closing costs

You’ll need to pay closing costs rounding up to 2-5% of the loan.

5) Monthly payments can get higher

If the interest rate of a HELOC goes higher, your monthly payments will increase and may become unaffordable.

6) You can owe more than your property’s worth

If your home goes underwater, you’ll end up owing more than the value of your home, and the lender can freeze your credit line, leaving you with no access to funds.

Repaying A HELOC

Before incurring more debt, it is in your best interest to carefully read the loan agreement. Most HELOC lenders require you to pay interest-only payments during the draw period. You can also pay toward your principal during this period to reduce the interest accumulated and the burden of repaying much during the repayment period.

HELOC Payment Calculator

Get an estimate of your monthly HELOC payments with the help of a HELOC calculator. You can calculate your HELOC payments here.

Best Alternatives To A Home Equity Loan Or HELOC

If you want to know the alternatives to both loans, read this section.

1) Cash-out Refinance

With a cash-out refinance, you have the leverage to replace your current mortgage with a bigger one. A lender subtracts your original mortgage from the new mortgage, and you receive the difference in cash. You can use a cash-out refinance for any financial needs you need to cater to—such as tuition, home improvements, or medical bills.

2) Credit Cards

Credit cards are good alternatives to both a HELOC or home equity loan. A credit card is a revolving line of credit that enables you to borrow money, repay it, and borrow it when necessary. You can go for a secured credit card or the regular one (unsecured credit card). If you plan to use a credit card, avoid unnecessary spending and watch out for the high-interest rate.

3) Personal Loans

For personal loans, you get a lump sum from a lender that you can use to fund different needs such as medical bills, home improvement, or a wedding. Personal loans have a fixed monthly repayment plan with terms for up to 6 years. This type of loan usually has a lower interest rate than a regular credit card. You can get this type of loan through credit card issuers, credit unions, online lenders, or banks.

4) Reverse Mortgage

A reverse mortgage can benefit retired homeowners by allowing them to access their home equity.

With this type of mortgage loan, older adults (62 years and above) can use their homes as collateral to borrow funds. The homeowner can use this type of loan to sort out different needs such as home refurbishing, medical bills, in-home care, or travel. The loan or principal payment is due when the following conditions occur: the homeowner leaves the home permanently, sells the home, or dies.

5) Home Equity Sharing Agreements

With this type of loan, a homeowner can get funds by receiving a percentage of their home’s value through a lender. The amount you can receive depends on how much equity you own. You don’t need to pay monthly principal or interest-only payments. After the loan term ends, the homeowner has to pay the loan and give the lender a percentage of the appreciated value of their home. Homeowners with low credit scores can benefit from this type of loan.

You can also sell the home and pay the lender the borrowed amount plus a percentage of the increase in the home's value. One of the disadvantages of this loan is that if a lender takes a portion of your home equity when your home appreciates significantly—you end up losing a chunk of your equity.

NOTE: You can also use a home equity loan as an alternative to a HELOC or vice versa.

Interest Rates For A HELOC & Home Equity Loan

According to Investopedia, here are the interest rates for a home equity loan & HELOC:

The interest rate for a HELOC can vary from month to month. It can also vary depending on the lender or the location of your home.

Comparison Between A Home Equity Loan And A HELOC

The table below highlights the differences between a HELOC and a home equity loan.

Take Note: some lenders can also offer home equity loans with variable rates and HELOCs with fixed rates (this is usually rare).

FAQ About Home Equity Loan & HELOC

What are the differences between a HELOC and a second mortgage?

With a HELOC, you have the leverage to access funds frequently, while a second mortgage (home equity loan) gives you access to a lump sum. There is also a fixed interest rate on a second mortgage compared to the variable interest rate of a HELOC. With a HELOC, you need to pay interest-only payments during the draw period, while you are obligated to pay both the principal and interest every month with a second mortgage.

How to pull equity out of your home?

There are various ways to pull equity out of your home. Here are some of the best mortgage options to do that: home equity loan, HELOC, reverse mortgage, home equity sharing agreements, or a cash-out refinance.

How to increase your home equity?

You can boost your home equity by making a large down payment when securing a mortgage, improving or refurbishing your home, paying your mortgage faster, avoiding a cash-out refinance, opting for a shorter loan term, avoiding mortgage insurance, and paying off your closing costs.

How soon can you get a home equity line of credit (HELOC) after purchase?

If you meet all the requirements for a HELOC, you can secure it 30 to 45 (or up to 6 weeks) days after purchasing your home. Sometimes, the timeframe can also depend on the lender you used.

Can I cancel my HELOC or home equity loan?

Yes, but you only have three business days to cancel the loan—starting from the day of closing. You'll also need to send a written notice to your lender via mail before midnight of the third business day.

Can you repay a home equity loan too early?

Yes, but you may face penalties. Ensure you reread your loan contract to see if there are any penalties you could encounter if you decide to increase your monthly loan payment.

FINAL TIP: It is more beneficial to go for a home equity loan or HELOC when the value of your home in the real estate market increases.

Wrapping Up

You can secure a HELOC or home equity loan based on your preference. Both loans have advantages and disadvantages. If you need frequent access to cash, a HELOC is the best option. A home equity loan will be a great option if you need a large sum of money right away. You should also avoid splurging with these loans to avoid incurring a large debt.

Do you need engaging and well-researched finance articles? Get in touch with me. I can help you with your content needs.